Proposal to Overhaul Child Tax Credit Would Significantly Lower Poverty Rate

By Devin Simpson

New legislation proposed by U.S. Senators Michael Bennet (D-CO) and Sherrod Brown (D-OH) would significantly lower child poverty rates by radically expanding the Child Tax Credit (CTC) and creating a tax credit for children under age six.

The American Family Act of 2017 would expand the maximum credit under the CTC from $1,000 to $3,000 a year and increase the cut-off age for eligibility from 17 to 19. The legislation’s proposed Young Child Tax Credit would provide $3,600 per year for children under age six. Both credits would be indexed for inflation and fully refundable to benefit families at the lowest-income level.

Additionally, the proposal would distribute payments for each credit monthly to provide more financial relief for families throughout the year.

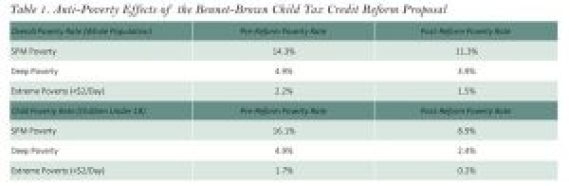

Christopher Wimer and Sophie Collyer, researchers at the Center on Poverty and Social Policy at Columbia University, analyzed the impact of the proposal on poverty rates. They found that it would cut child poverty and deep child poverty, defined as a family income below half of the federal poverty line, almost in half. It would virtually eliminate extreme child poverty, which is defined as having less than $2 per day, per person.

While the legislation would have the most significant impact on child poverty, it would also decrease overall poverty rates, lifting approximately seven million children and five million adults out of poverty, according to the research.

To read Wimer and Collyer’s report, click here.